25+ 50 year term life insurance policy quote at 15 million information

Home » Wallpapers » 25+ 50 year term life insurance policy quote at 15 million informationYour 50 year term life insurance policy quote at 15 million images are available in this site. 50 year term life insurance policy quote at 15 million are a topic that is being searched for and liked by netizens today. You can Get the 50 year term life insurance policy quote at 15 million files here. Download all free photos and vectors.

If you’re searching for 50 year term life insurance policy quote at 15 million pictures information related to the 50 year term life insurance policy quote at 15 million topic, you have visit the ideal site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

50 Year Term Life Insurance Policy Quote At 15 Million. Now however I know there are several good reasons a client might need that much coverage. The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors. We have broken down the premiums by each rating class. You must be able to financially justify your need for the amount of coverage you desire.

How Much Does Million Dollar Life Insurance Cost Who Needs It From goodfinancialcents.com

How Much Does Million Dollar Life Insurance Cost Who Needs It From goodfinancialcents.com

Who Needs 1 Million to 2 Million in Life Insurance Coverage. The below table represents actual monthly life insurance rates for a 15 year term life insurance policy with a death benefit options of 1000000 2000000 3000000 4000000 and 5000000. If you are not sure how much life insurance you need play around with our needs calculator. Purchasing 2000000 to 5000000 of life insurance coverage is commonly done by individuals with. Term life is the most basic form of protection but for many 59-year-olds it makes sense they have less debts and more wealth and theyre putting more money toward their 401ks and IRAs. I had never thought that I would need a million dollars of term life insurance.

With 10 years of experience and hundreds of clients under my belt I can easily make an argument for why a spouse parent or business owner might need 1 Million to 2 Million of term life insurance.

The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors. Average term life insurance rates by age. For a healthy person between ages 18 to 70 life insurance costs an average 7061 a month for a 20-year 250000 policy. Whole Life Insurance Quotes Whole Life Insurance 1 Million Cost. As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year. Get a free life insurance quote to find your exact premium or find the average rate for your age in the table.

Source: momanddadmoney.com

Source: momanddadmoney.com

Get a free life insurance quote to find your exact premium or find the average rate for your age in the table. Whole Life Insurance Quotes Whole Life Insurance 1 Million Cost. Average Cost for Million Dollar 15 Year Term Life Insurance Policy. The below table represents actual monthly life insurance rates for a 15 year term life insurance policy with a death benefit options of 1000000 2000000 3000000 4000000 and 5000000. To show you how much it varies here are some example premiums for a 1000000 20 year level term policy.

Source: ar.pinterest.com

Source: ar.pinterest.com

Purchasing 2000000 to 5000000 of life insurance coverage is commonly done by individuals with. The tables below detail quotes for 10- and 20-year term life policies. Since there are so many variables that go into the cost of life insurance it makes it impossible to say how much a certain amount of insurance costs without that other information. Average Cost for Million Dollar 15 Year Term Life Insurance Policy. Purchasing 2000000 to 5000000 of life insurance coverage is commonly done by individuals with.

Source: pinterest.com

Source: pinterest.com

From there you can run a term life insurance quote. We have broken down the premiums by each rating class. Get a free life insurance quote to find your exact premium or find the average rate for your age in the table. As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year. With this post.

Source: in.pinterest.com

Source: in.pinterest.com

Term life insurance rates by policy length. Consulting with your family prior to making any serious purchasing decisions should allow you the chance to explain what will happen in the event this policy is acted upon. Since there are so many variables that go into the cost of life insurance it makes it impossible to say how much a certain amount of insurance costs without that other information. A healthy 50-year-old can get a policy for 101 per month for men and 81 per month for women. This policy was in addition to the 30-year 250000 policy I bought in my late 20s meaning I now have 1 million in term life insurance coverage that will last until Im 57.

Source: lifeinsuranceshoppingreviews.com

Source: lifeinsuranceshoppingreviews.com

When you take out a life cover policy you pay a premium every month and in the event of the life assureds death 1Life pays your beneficiaries for example your family or other dependants a lump sum. With 10 years of experience and hundreds of clients under my belt I can easily make an argument for why a spouse parent or business owner might need 1 Million to 2 Million of term life insurance. But on the other hand it might not be enough depending on your family situation. When I was a rookie agent I used to think 3 million 4 million or 5 million in term life insurance was too much coverage for anyone. When you take out a life cover policy you pay a premium every month and in the event of the life assureds death 1Life pays your beneficiaries for example your family or other dependants a lump sum.

Source: pinterest.com

Source: pinterest.com

To show you how much it varies here are some example premiums for a 1000000 20 year level term policy. Consulting with your family prior to making any serious purchasing decisions should allow you the chance to explain what will happen in the event this policy is acted upon. But on the other hand it might not be enough depending on your family situation. You must be able to financially justify your need for the amount of coverage you desire. Blending a whole life policy with term insurance can reduce costs significantly.

Source: policybazaar.com

Source: policybazaar.com

Blending a whole life policy with term insurance can reduce costs significantly. 1 Crore Term Insurance Plan. Purchasing 2000000 to 5000000 of life insurance coverage is commonly done by individuals with. A life insurance policy is there to make sure that a family has financial protection when the breadwinner passes away. When you take out a life cover policy you pay a premium every month and in the event of the life assureds death 1Life pays your beneficiaries for example your family or other dependants a lump sum.

Source: investopedia.com

Source: investopedia.com

Turns out that after having three children to provide for I now have a 25 million term policy. As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year. Average term life insurance rates by age. A healthy 50-year-old can get a policy for 101 per month for men and 81 per month for women. Get a Life insurance quote Reset.

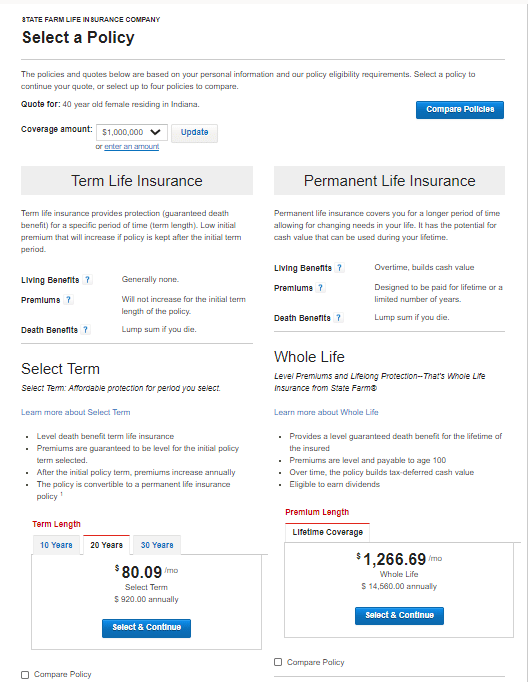

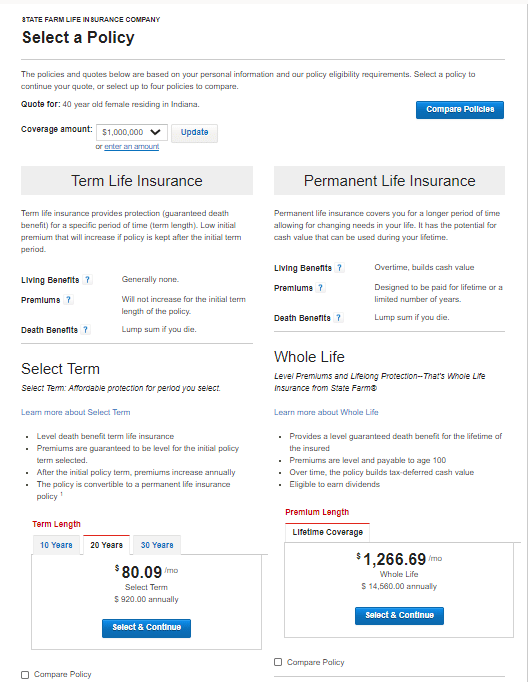

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors. Term life is the most basic form of protection but for many 59-year-olds it makes sense they have less debts and more wealth and theyre putting more money toward their 401ks and IRAs. Blending a whole life policy with term insurance can reduce costs significantly. A healthy 50-year-old can get a policy for 101 per month for men and 81 per month for women. The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

The majority of 59-year-olds choose a 10- or 20-year term life policy. A life insurance policy is there to make sure that a family has financial protection when the breadwinner passes away. Average Cost for Million Dollar 15 Year Term Life Insurance Policy. With this post. Now however I know there are several good reasons a client might need that much coverage.

Source: havenlife.com

Source: havenlife.com

A life insurance policy is there to make sure that a family has financial protection when the breadwinner passes away. You can get this policy without an exam and in under 5 minutes. Now however I know there are several good reasons a client might need that much coverage. With 10 years of experience and hundreds of clients under my belt I can easily make an argument for why a spouse parent or business owner might need 1 Million to 2 Million of term life insurance. Average term life insurance rates by age.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Average Cost for Million Dollar 15 Year Term Life Insurance Policy. The below table represents actual monthly life insurance rates for a 15 year term life insurance policy with a death benefit options of 1000000 2000000 3000000 4000000 and 5000000. After our first child I added an additional 500000 and after our second child I really ramped it and purchased another 15 million dollar 30-year term life insurance policy for a grand total of 225 million dollars. Large Policy Buyers An Elite Group. As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year.

Source: masonfinance.com

Source: masonfinance.com

The below table represents actual monthly life insurance rates for a 15 year term life insurance policy with a death benefit options of 1000000 2000000 3000000 4000000 and 5000000. From there you can run a term life insurance quote. It will point you in the right direction. Whole Life Insurance Quotes Whole Life Insurance 1 Million Cost. A one million dollar life insurance policy may not be necessary for everyone.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

Now however I know there are several good reasons a client might need that much coverage. Blending a whole life policy with term insurance can reduce costs significantly. As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year. I am sure you can agree that gettingterm life insurance quotes onlinecan be super annoyingFrom the 100s of phone calls to random emails and not really knowing which agent you spoke to lastWhat if I told you that not only can you get quotes without giving up personal information but you can get the best term life insurance rates by age easily by looking through them below. If you are not sure how much life insurance you need play around with our needs calculator.

Source: pinterest.com

Source: pinterest.com

Consulting with your family prior to making any serious purchasing decisions should allow you the chance to explain what will happen in the event this policy is acted upon. You might be surprised to learn that not just anyone can buy a policy for say 4 million dollars. Now however I know there are several good reasons a client might need that much coverage. After I got married 250000 at the time I thought was more than enough and it probably was. With 10 years of experience and hundreds of clients under my belt I can easily make an argument for why a spouse parent or business owner might need 1 Million to 2 Million of term life insurance.

Source: money.com

Source: money.com

1 Crore Term Insurance Plan. After our first child I added an additional 500000 and after our second child I really ramped it and purchased another 15 million dollar 30-year term life insurance policy for a grand total of 225 million dollars. With 10 years of experience and hundreds of clients under my belt I can easily make an argument for why a spouse parent or business owner might need 1 Million to 2 Million of term life insurance. The tables below detail quotes for 10- and 20-year term life policies. We also provide an accelerated terminal illness benefit and optional funeral benefits.

Source: goodfinancialcents.com

Source: goodfinancialcents.com

With this post. When you take out a life cover policy you pay a premium every month and in the event of the life assureds death 1Life pays your beneficiaries for example your family or other dependants a lump sum. You might be surprised to learn that not just anyone can buy a policy for say 4 million dollars. Turns out that after having three children to provide for I now have a 25 million term policy. Blending a whole life policy with term insurance can reduce costs significantly.

Source: insurancehero.org.uk

Source: insurancehero.org.uk

You might be surprised to learn that not just anyone can buy a policy for say 4 million dollars. With this post. You might be surprised to learn that not just anyone can buy a policy for say 4 million dollars. After I got married 250000 at the time I thought was more than enough and it probably was. You can get this policy without an exam and in under 5 minutes.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 50 year term life insurance policy quote at 15 million by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.