45++ 3rd party property car insurance quotes ideas in 2021

Home » Background » 45++ 3rd party property car insurance quotes ideas in 2021Your 3rd party property car insurance quotes images are ready. 3rd party property car insurance quotes are a topic that is being searched for and liked by netizens now. You can Download the 3rd party property car insurance quotes files here. Get all free photos and vectors.

If you’re looking for 3rd party property car insurance quotes images information connected with to the 3rd party property car insurance quotes keyword, you have visit the right blog. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

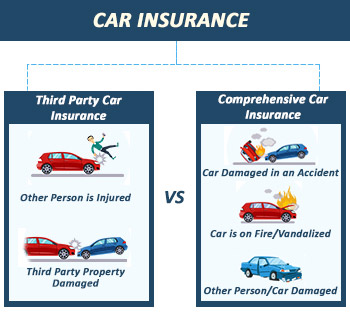

3rd Party Property Car Insurance Quotes. Third Party car insurance is not the same as Compulsory Third Party CTP insurance. It covers you for damage you cause to other peoples cars or property in an accident. This is the easiest and cheapest way to secure third party car insurance. The main thing you get with Third Party Property Damage Insurance is liability cover.

Buy Third Party Insurance Online Online Insurance Compare Insurance Insurance Quotes From in.pinterest.com

Buy Third Party Insurance Online Online Insurance Compare Insurance Insurance Quotes From in.pinterest.com

Its in your best interest to compare the cost of third party car insurance from multiple providers before you make a decision. Our Third Party Property Damage Car Insurance simply provides cover for damage you cause to someone elses vehicle and property. CTP only covers anyone who is injured as a result of an accident thats deemed your fault. It provides coverage for bodily injurydeath of a third party as decided by a court of law as well as third party property damage up to Rs. Third party property car insurance which generally only covers your liability for the damage your car causes to other peoples property including their vehicles. No Third Party Property Damage insurance isnt the same as Compulsory third party CTP but its easy to get them confused.

Accidents can happen at any time.

Consider Third Party Property Damage Insurance or feel even more assured by upgrading to GIOs Fire Theft and Third Party Damage Insurance which covers fire theft. Third party property car insurance which generally only covers your liability for the damage your car causes to other peoples property including their vehicles. Third-party insurance only covers this and nothing else except for some policies which partially cover damage to your vehicle as well even if you are at fault. So our Third Party Property Damage cover protects you if you cause damage to another persons vehicle and includes liability cover for any person who is legally driving your car with your permission. It covers you for damage you cause to other peoples cars or property in an accident. Third party car insurance is often double the price of a fully comprehensive policy.

Source: pinterest.com

Source: pinterest.com

Third Party Property Damage Insurance is a type of car insurance that gives you a basic level of cover for damage caused by your car to another persons vehicle or property. Its a basic level of cover all our car insurance policies come with liability cover up to 20 million. 50 of people could achieve a quote of 148535 per year for their third party car insurance based on Compare the Market data in November 2020 50 of people could achieve a quote of 91840 per year for their third party fire and theft car insurance based on Compare the Market data in November 2020. It covers you for accidentally causing injury to others damage to third party property and liability while towing. CTP also known as Green Slip in New South Wales is a mandatory requirement for all registered cars.

Source: iselect.com.au

Source: iselect.com.au

Third party property car insurance which generally only covers your liability for the damage your car causes to other peoples property including their vehicles. Compulsory third party CTP insurance which covers compensation claims made against you for injuring or killing someone in an accident. Third-party insurance only covers this and nothing else except for some policies which partially cover damage to your vehicle as well even if you are at fault. Its in your best interest to compare the cost of third party car insurance from multiple providers before you make a decision. The main thing you get with Third Party Property Damage Insurance is liability cover.

Source: in.pinterest.com

Source: in.pinterest.com

This is the easiest and cheapest way to secure third party car insurance. Third Party car insurance is not the same as Compulsory Third Party CTP insurance. Third-party insurance only covers this and nothing else except for some policies which partially cover damage to your vehicle as well even if you are at fault. 50 of people could achieve a quote of 148535 per year for their third party car insurance based on Compare the Market data in November 2020 50 of people could achieve a quote of 91840 per year for their third party fire and theft car insurance based on Compare the Market data in November 2020. Its in your best interest to compare the cost of third party car insurance from multiple providers before you make a decision.

Source: realinsurance.com.au

Source: realinsurance.com.au

Third Party Property Damage Car Insurance covers damage you cause to other peoples vehicles and property while behind the wheel. It provides the driver cover for any legal liability for injury and death as a result of an accident for which the insured is responsible be it for other. It provides coverage for bodily injurydeath of a third party as decided by a court of law as well as third party property damage up to Rs. No Third Party Property Damage insurance isnt the same as Compulsory third party CTP but its easy to get them confused. Award winning car insurance The quality experts at Canstar surveyed over 6400 car insurance policy holders across 42 insurers nationally and awarded RAC with WAs Most Satisfied Customers.

Source: pinterest.com

Source: pinterest.com

Start an online quote today. CTP also known as Green Slip in New South Wales is a mandatory requirement for all registered cars. Third Party Property Damage Insurance is a type of car insurance that gives you a basic level of cover for damage caused by your car to another persons vehicle or property. It covers you for damage you cause to other peoples cars or property in an accident. NRMA Third Party Property Damage Car Insurance covers damage to your car caused by an at fault driver up to 5000.

Source: in.pinterest.com

Source: in.pinterest.com

Third party only TPO car insurance is the most basic car insurance you can lawfully buy in the UK. Award winning car insurance The quality experts at Canstar surveyed over 6400 car insurance policy holders across 42 insurers nationally and awarded RAC with WAs Most Satisfied Customers. You can search for third party insurance quotes online to see how much you could pay. So our Third Party Property Damage cover protects you if you cause damage to another persons vehicle and includes liability cover for any person who is legally driving your car with your permission. Third Party Property Damage Insurance is a type of car insurance that gives you a basic level of cover for damage caused by your car to another persons vehicle or property.

Source: in.pinterest.com

Source: in.pinterest.com

Third Party Car Insurance. This is the easiest and cheapest way to secure third party car insurance. During our analysis of 9 Australian car insurance brands we found that the average cost of third party property damage car insurance was 317 a year or 26 a month. Third Party car insurance is not the same as Compulsory Third Party CTP insurance. Third party only TPO car insurance is the most basic car insurance you can lawfully buy in the UK.

Source: policyx.com

Source: policyx.com

When you buy a Third Party Car Insurance policy you become an RAC member and get a whole heap of great extra benefits so you can make savings every day. CTP only covers anyone who is injured as a result of an accident thats deemed your fault. Start an online quote today. Third party car insurance is often double the price of a fully comprehensive policy. Save up to 25 depending on your entire Policy Count including Roadside Assistance and Years of Relationship.

Source: pinterest.com

Source: pinterest.com

Third Party Property Damage Insurance is a type of car insurance that gives you a basic level of cover for damage caused by your car to another persons vehicle or property. It provides coverage for bodily injurydeath of a third party as decided by a court of law as well as third party property damage up to Rs. Start an online quote today. CTP also known as Green Slip in New South Wales is a mandatory requirement for all registered cars. NRMA Third Party Property Damage Car Insurance covers damage to your car caused by an at fault driver up to 5000.

Source: insurance.woolworths.com.au

Source: insurance.woolworths.com.au

50 of people could achieve a quote of 148535 per year for their third party car insurance based on Compare the Market data in November 2020 50 of people could achieve a quote of 91840 per year for their third party fire and theft car insurance based on Compare the Market data in November 2020. This is the easiest and cheapest way to secure third party car insurance. Our Third Party Property Damage Car Insurance simply provides cover for damage you cause to someone elses vehicle and property. Third-party insurance only covers this and nothing else except for some policies which partially cover damage to your vehicle as well even if you are at fault. So our Third Party Property Damage cover protects you if you cause damage to another persons vehicle and includes liability cover for any person who is legally driving your car with your permission.

Source: pinterest.com

Source: pinterest.com

NRMA Third Party Property Damage Car Insurance covers damage to your car caused by an at fault driver up to 5000. CTP only covers anyone who is injured as a result of an accident thats deemed your fault. Third party property car insurance which generally only covers your liability for the damage your car causes to other peoples property including their vehicles. Start an online quote today. Its different from Compulsory Third Party Insurance such as CTP in SA or Green Slip in NSW which just covers costs related to injuries caused in a motor vehicle accident for which youre liable.

Source: pinterest.com

Source: pinterest.com

Compulsory third party CTP insurance which covers compensation claims made against you for injuring or killing someone in an accident. CTP only covers anyone who is injured as a result of an accident thats deemed your fault. You can search for third party insurance quotes online to see how much you could pay. CTP is mandatory by law for all drivers in Australia and is sometimes included in the registration fee for the car. Third Party Property Damage Car Insurance Discounts Quotes.

Source: ar.pinterest.com

Source: ar.pinterest.com

Its a basic level of cover all our car insurance policies come with liability cover up to 20 million. This is the easiest and cheapest way to secure third party car insurance. Award winning car insurance The quality experts at Canstar surveyed over 6400 car insurance policy holders across 42 insurers nationally and awarded RAC with WAs Most Satisfied Customers. Start an online quote today. If you buy third party car insurance youll still need to register your car and if you live in NSW QLD SA or ACT purchase separate CTP insurance which is known as Green Slip in NSW.

Source: ar.pinterest.com

Source: ar.pinterest.com

Find out why third party cover is so expensive and compare car insurance quotes now to get the cheapest price for your preferred type of policy. It provides the driver cover for any legal liability for injury and death as a result of an accident for which the insured is responsible be it for other. Third Party Car Insurance. 50 of people could achieve a quote of 148535 per year for their third party car insurance based on Compare the Market data in November 2020 50 of people could achieve a quote of 91840 per year for their third party fire and theft car insurance based on Compare the Market data in November 2020. Find out why third party cover is so expensive and compare car insurance quotes now to get the cheapest price for your preferred type of policy.

Source: policybazaar.com

Source: policybazaar.com

Its a basic level of cover all our car insurance policies come with liability cover up to 20 million. Its in your best interest to compare the cost of third party car insurance from multiple providers before you make a decision. The main thing you get with Third Party Property Damage Insurance is liability cover. Third Party Car Insurance. Compulsory third party CTP insurance which covers compensation claims made against you for injuring or killing someone in an accident.

Source: pinterest.com

Source: pinterest.com

It provides coverage for bodily injurydeath of a third party as decided by a court of law as well as third party property damage up to Rs. Third Party Property Damage Car Insurance Discounts Quotes. Start an online quote today. NRMA Third Party Property Damage Car Insurance covers damage to your car caused by an at fault driver up to 5000. Consider Third Party Property Damage Insurance or feel even more assured by upgrading to GIOs Fire Theft and Third Party Damage Insurance which covers fire theft.

Source: in.pinterest.com

Source: in.pinterest.com

Compulsory Third Party insurance CTP or greenslip as its most commonly known as in NSW is something all vehicles are required to be covered by in all states within Australia. Third Party Property Damage Car Insurance Discounts Quotes. Third Party Property Damage cover. It covers you for accidentally causing injury to others damage to third party property and liability while towing. CTP covers other people if they are injured by you but does not protect you against damaging their vehicle or property.

Source: pinterest.com

Source: pinterest.com

Its in your best interest to compare the cost of third party car insurance from multiple providers before you make a decision. Third party only TPO car insurance is the most basic car insurance you can lawfully buy in the UK. Third-party insurance is a car insurance coverage which insures you against all the 3rd party legal liabilities which may arise due to any mishap such as a road accident involving your car. During our analysis of 9 Australian car insurance brands we found that the average cost of third party property damage car insurance was 317 a year or 26 a month. Its a basic level of cover all our car insurance policies come with liability cover up to 20 million.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 3rd party property car insurance quotes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.